Today we wanted to build on our last message about how our fear of regret often leads us to take more risk than is necessary and chase performance. It makes it hard for us to just diversify and sit tight through the roller coaster of good times and bad. Remember our previous example of investing internationally instead of just in the US. After all, when the US market has been on a prolonged hot streak why would we want to be anywhere else?

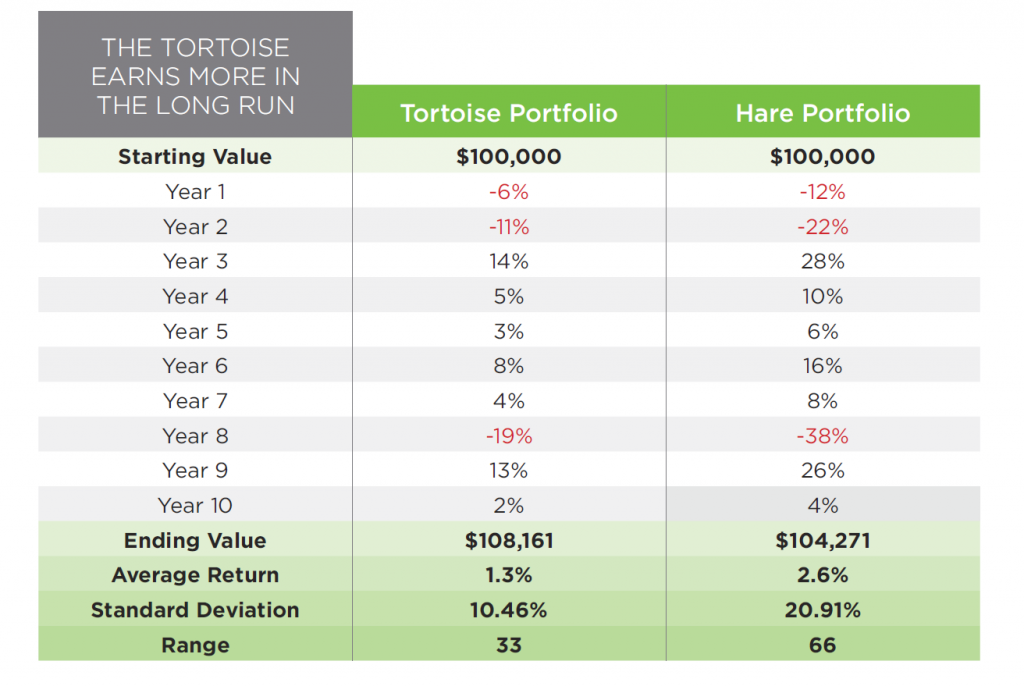

The answer lies in the numbers. You see, often an investment strategy that has a lower standard deviation (a number that measures the swings in an investment’s, or group of investments, performance) can show a lower average return but still end up with a higher account value in the end. Having an investment strategy comprised of investments that don’t all act the same can reduce those swings. Don’t believe me? Take a look at the slides we linked to below. We’ll wait…

Which one would you have picked? Option one or option two? Option two looked better until you pick up a calculator and do the math. As the slide says, the tortoise earns more in the long run.

We’d like to point out that this is one reason we don’t use average return to demonstrate performance, we use a

The point is, there can be benefits to being a well-diversified tortoise on the path to investing. You may not always finish first, but you have a much greater chance of actually reaching your destination.